We can find different strategies within private capital investment. Although they all share the same characteristic (investment in unlisted, private companies), there are some differences. Some are easy to distinguish, for example, private debt investment and infrastructure investment. However, finding differences in others can be more complicated.

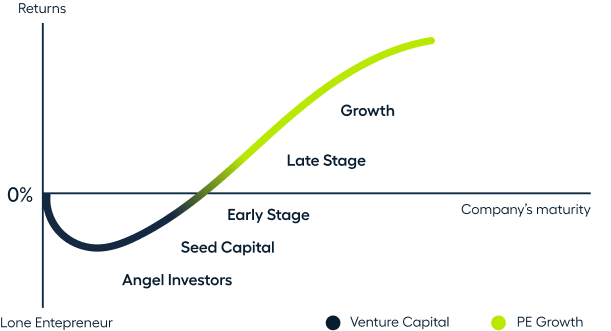

In this post we explain the difference between Private Equity Growth and Venture Capital. They mainly differ in the companies' growth stage, the risk they take on, the return they offer and the investment period and volume.

Private Equity Growth involves entering established companies that can continue to grow and expand. Growth plans are usually financed through the internationalisation of the business.

On the other hand, Venture Capital Venture Capital invests in much less mature companies. These companies have just started and made their first sales, so they are still testing the viability of the business. This type of investment constitutes one of the main sources of funding for startups.

The companies in which it invests are usually in an early stage of development; therefore, the investment aims to fund the business plan designed by the founders.

The companies in which PE Growth funds invest involve much lower risks, as they are established companies and have already been successful in a specific market. Primarily, the risks taken on are management related.

In addition, there are much fewer companies in this stage and few funds have access to them. Therefore, in this type of strategy, if possible, what is most important is gaining access to the best funds that are able to take advantage of the best opportunities. “The dispersion between bad funds, good funds and top-tier funds is enormous, and an expert selection will make the difference in your portfolio's profitability”, explains Crescenta's investment team with respect to PE Growth funds. The risk-return ratio is very high in this strategy.

The companies in which Venture Capital funds invest are still validating their business model, so much more risk is assumed in the investment. The flip side is that, by entering as soon as possible, the potential returns are much higher if the company performs well. The risks are mainly associated with the product or service they offer, the market and an adequate management of the company. There are also many more VC than PE Growth companies, so their selection also plays a key role.

At Crescenta you can invest in a selection of the best international Private Equity Growth funds through the Crescenta PE Growth Top Performers I portfolio. This portfolio invests in Insight, the most prestigious PE Growth fund, which has access to the best companies.

The companies funded by PE Growth funds usually need investment for short-term goals, such as opening up new markets. Therefore, the investment period is usually around five to six years.

Meanwhile, as VCcompanies are newly created companies, they need more time to mature, test the viability of the business and reach their potential, so the investment timelines in Venture Capital are longer than in PE Growth funds. They can reach from eight to ten years.

In PE Growth companies, funding rounds usually exceed €25 million. Investors acquire small positions and delegate the company's management to the management team, although they contribute with their experience and can advise on strategies.

Meanwhile, the rounds of the companies in Venture Capital funds are much smaller; they do not exceed €25 million. In these companies, the managers (GP) take small positions, because the investment is intended to fund the business plan. However, the GPs get actively involved in the company's strategic decisions, with the aim of advising it by contributing with their experience and to the business' development.

This content is merely indicative. This content is merely financial training offered to you by Crescenta, without the intention of giving any type of personalised investment recommendation.

It is neither any type of advertising of financial instruments nor a recommendation or purchase offer.

Author

Sofía Cisneros

Comunicación y contenidos - Crescenta

La principal diferencia entre los fondos de Venture Capital y PE Growth es la etapa en la que se encuentra la empresa en la que invierten

Los fondos de Venture Capital son menos arriesgados que los fondos de PE Growth

El periodo de inversión es similar en ambos tipos de estrategias

When you click on any underlined term, you can see a definition and example of each concept

When you click on any underlined term, you can see a definition and example of each concept

When you click on any underlined term, you can see a definition and example of each concept