As its name suggests, a fund of funds is an investment vehicle that invests in other funds. This quality involves achieving a high degree of diversification with a single investment.

In this post we explain what a fund of funds of private capital is, their advantages and why it can be an attractive vehicle to invest in private capital.

investing in a fund of funds is like buying a range of nuts, instead of buying hazelnuts, almonds and walnuts separately, you buy a packet with all three. That is, through a fund of funds, we invest in a single vehicle that invests in various funds, thus providing the investor with a high degree of diversification and spreading the risk. In addition, the fund of funds can invest a maximum of 25% of its capital in each underlying fund.

Investing with funds of funds is a simple strategy that simplifies the investment process, providing you optimal and immediate exposure to a single vehicle.

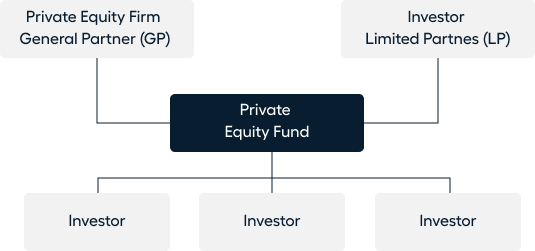

Funds of funds offer investors a professional management service: a manager (GP) will select the management companies and funds that will make up the vehicle. Moreover, by investing through a fund structure, investors are able to access funds or management companies that would otherwise be inaccessible to them due to the minimum investment requirements. They also provide lower volatility and risk.

Another aspect to consider is that by investing in a fund of funds, the investors' expenses can be reduced if the alternative would be to build a portfolio by investing separately in the funds in which the fund of funds invests.

All these advantages make them an excellent investment option for retail investors, since they can achieve an adequate diversification, quality funds, lower volatility and lower risk through a single vehicle.

However, all investments entail a risk, which is why making informed decisions that are in line with your risk profile, net worth and investment horizon is important.

Crescenta has a team of professionals with decades of experience dedicated exclusively to building diversified and complementary portfolios that optimise the risk-return ratio.

Author

Sofía Cisneros

Comunicación y contenidos - Crescenta

A fund of funds is an optimal vehicle for retail investors

Investing through funds of funds is a complex means of investment

A fund of funds increases the portfolio's volatility

When you click on any underlined term, you can see a definition and example of each concept

When you click on any underlined term, you can see a definition and example of each concept

When you click on any underlined term, you can see a definition and example of each concept