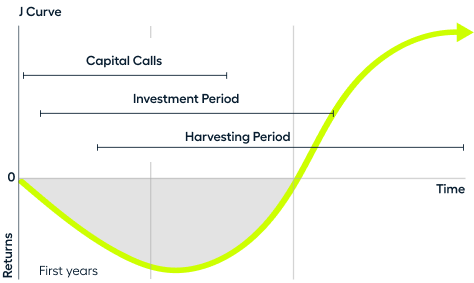

The J Curve describes the net asset value of a private capital fund and its trend of obtaining negative results in the first few years and subsequently obtaining very high returns.

In this post we explain the life cycle of a private capital fund, why it generates the so-called J curve and how it affects the funds.

In their early years, private equity funds earn negative returns due to the fact that value creation in a business is not immediate and due to the initial costs of investments and management fees.

The fund's objective is to recoup these initial losses by improving efficiency and creating value in the companies in which it has invested. Thus, as time passes and the fund makes profits from the sale of the underlying companies, the return on investment will far exceed the initial losses. The J-curve will then begin to develop: early losses fall below the initial value, and later returns show profits well above the initial level.

Curva J

Source: JP Morgan, "Know your Alternatives"

In the image we observe that in the first phase of the fund's life the returns are negative, but as time goes by, it begins to obtain high returns that allow it to recover with a wide margin the initial losses.

For less experienced investors, the course of the J-curve can be frustrating, seeing that during the first part of the investment there are no gains and there may even be losses. However, this type of investment has a long-term character, so keep in mind that it is not how it starts but how it ends, and that the fund's objective is to maximize the return, recovering the initial losses and generating an important profitability.

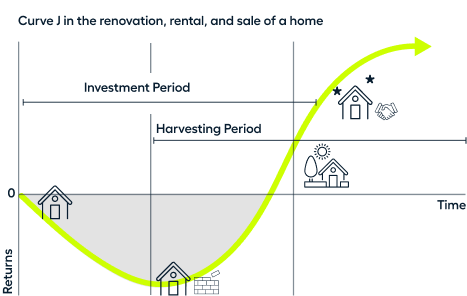

Here's an example: imagine you buy a house to renovate it, rent it and then sell it. At first, you pay a large amount for the purchase and then another for the renovation works; therefore, the first year and a half your investment suffers losses.

However, once it is ready, you start renting it and receive income for it. After a few years, you decide to sell the house, which has gained in value, so you obtain much more money than you initially invested. At first, you suffered a few years of losses (beginning of the J Curve), but you ended recouping your investment and more.

Author

Sofía Cisneros

Comunicación y contenidos - Crescenta

The J Curve represents the net asset value of a private capital fund

The J Curve explains why investing in private capital is a long-term investment

A private capital fund usually shows losses in its first years to later obtains much higher returns

When you click on any underlined term, you can see a definition and example of each concept

When you click on any underlined term, you can see a definition and example of each concept

When you click on any underlined term, you can see a definition and example of each concept