Redefining long term investing. Invest in growing private companies. A decision that brings you closer to your goals.

- Exclusive funds

- Expert selection

- Double digit returns

- Unlocking investment in global Private Equity funds from €10,000. Co-invest with the most experienced institutional investors to incorporate this asset to your portfolio.

- We select less than 3% of the funds we analyse. By structuring concentrated portfolios with 5–7 funds, we allow you to optimise your diversification with a single investment.

- Access funds with decades of experience and a consistent track record of double-digit** returns, such as Cinven, EQT, HG, Clearlake or Thoma Bravo. Now you can invest from 10,000* euros and up to millions.

Our partners

* Invest from 10,000 euros. If your investment ticket is below €100,000 and you are not a professional investor, you may invest provided that you do so under a financial advisory service. In the event that your financial assets do not exceed €500,000, the investment may not represent more than 10% of those assets. **The objective is based on simulated historical net returns obtained by previous funds that followed the same strategy as the selected underlying funds and were managed by the same asset manager, under a conservative scenario. The reference period for the simulation covers the entire duration of those previous funds (excluding those currently in their investment period at the time of analysis, which are not included for these purposes), measured in complete 12-month intervals. Source: internal analysis based on information provided by the asset managers of the underlying funds. Past performance is not a reliable indicator of future results. More information about risks and conditions available here.

Our trajectory

Vision and accuracy for your portfolio

Funds in commercialisation

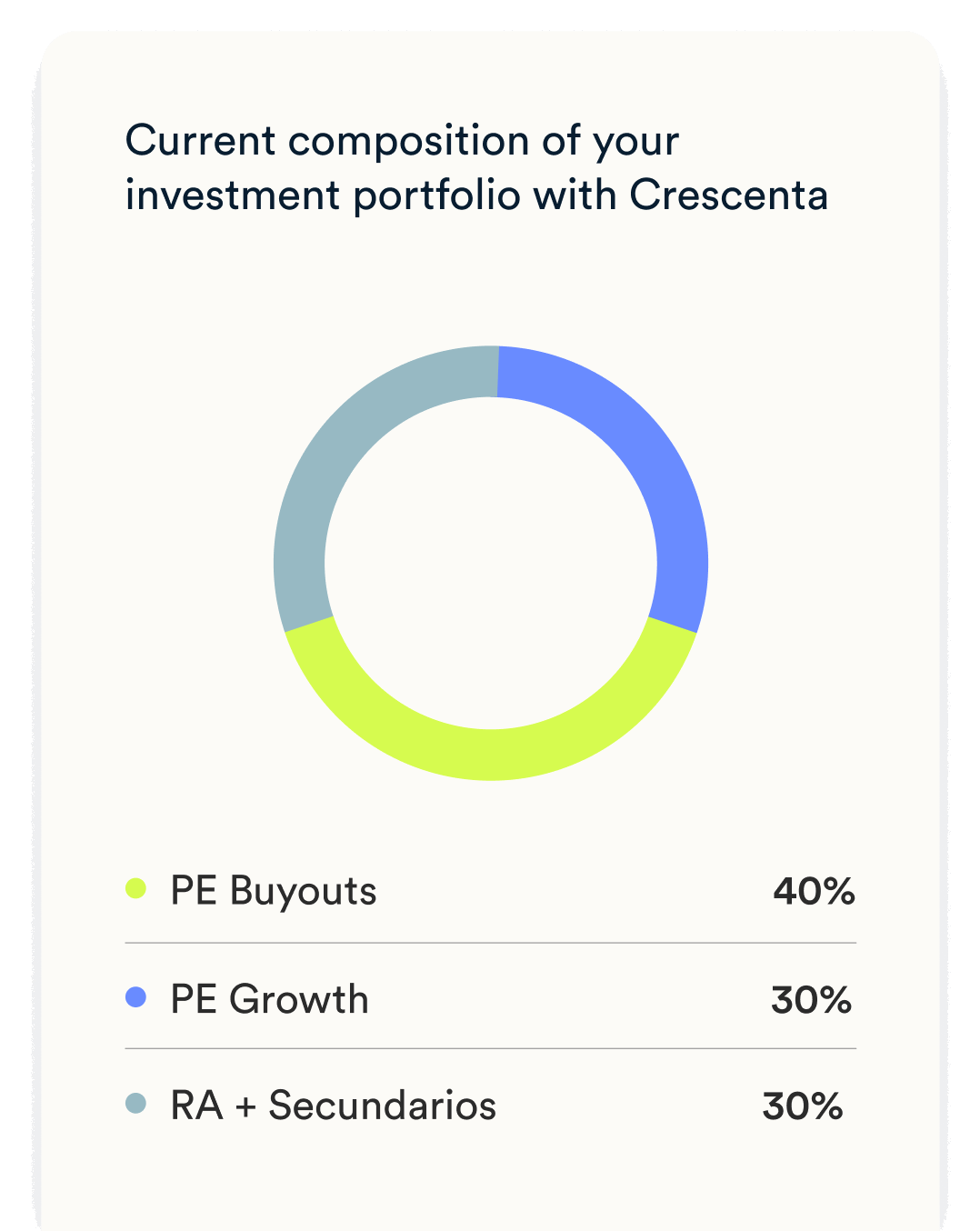

Invest in the megatrends that are defining and will define the world through an expert selection of funds. We design a portfolio that invests in a small number of leading funds specializing in private equity growth, tech buyouts, and secondary venture capital strategies. These funds invest in companies with high potential for appreciation, with highly recurring revenues and predictable cash flows, consolidated and scalable business models, and in advanced stages of growth, profitable or close to positive EBITDA.

A fund designed to provide retail and professional investors with access to one of the most dynamic and strategic areas of today’s private equity landscape. This vehicle enables participation in opportunistic GP-led and LP-led transactions within the secondary market, with a focus on developed markets.

It invests primarily in infrastructure, real estate and energy, with a focus on the US market. Its objective is to generate returns through asset appreciation and the income streams they produce, offering diversification and inflation protection.

Top Performers II, FCR

It is a portfolio of funds that invests in the main international funds of the Private Equity Buyouts strategy. This strategy is dedicated to taking majority positions in mature companies and applies strategies focused on business growth through operational and financial improvements over an average period of 3 to 5 years.

*The objective is based on simulated historical net returns obtained by previous funds that followed the same strategy as the selected underlying funds and were managed by the same asset manager, under a conservative scenario. The reference period for the simulation covers the entire duration of those previous funds (excluding those currently in their investment period at the time of analysis, which are not included for these purposes), measured in complete 12-month intervals. Source: internal analysis based on information provided by the asset managers of the underlying funds. Past performance is not a reliable indicator of future results. More information about risks and conditions available here

Top Performers II, FCR

This portfolio is a must-have fund selection for any investor interested in the most disruptive technology companies. It offers diversification, access to exclusive international funds and alpha, with expected returns well above public markets

Funds portfolio (fund of funds) with a main focus on Large Buyout top quartile-Flagship strategy funds: Cinven, EQT, Alpinvest, New Mountain... The fund consists of funds that mainly take majority positions (control position) in mature enterprises…

*The objective is based on simulated historical net returns obtained by previous funds that followed the same strategy as the selected underlying funds and were managed by the same asset manager, under a conservative scenario. The reference period for the simulation covers the entire duration of those previous funds (excluding those currently in their investment period at the time of analysis, which are not included for these purposes), measured in complete 12-month intervals. Source: internal analysis based on information provided by the asset managers of the underlying funds. Past performance is not a reliable indicator of future results. More information about risks and conditions available here

Become a

long-term investor

Start investing with a single click

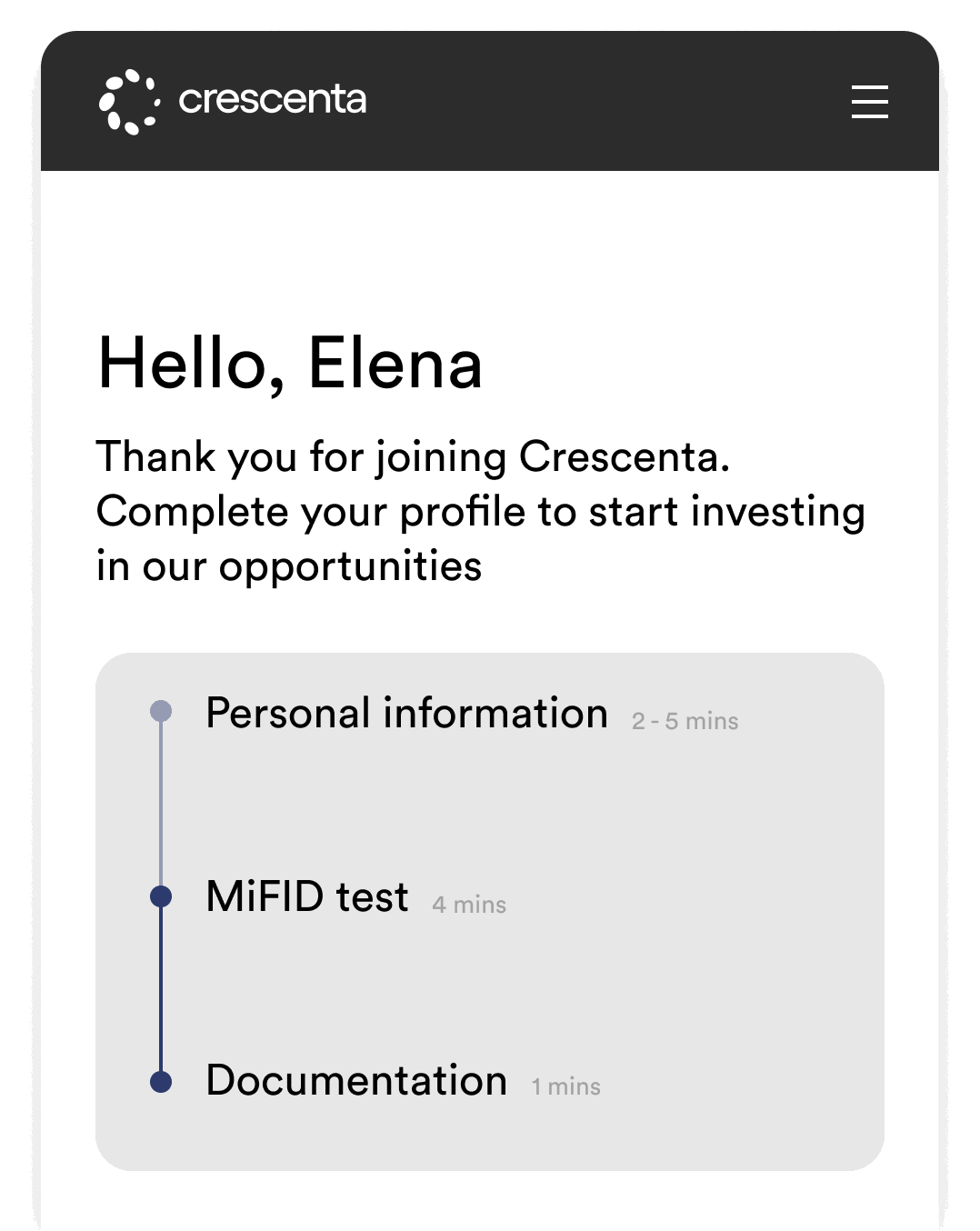

- Create your account

- Access the funds

- Invest

- Sign up at no cost or commitment to access the Crescenta ecosystem. Define your investor profile and knowledge level with our MiFID tests.

- Discover comprehensive fund information, strategy details, and insights from our investment team.

- Start building your portfolio from €10,000. With our digital advisory tool, you can identify the funds that best match your profile and goals.

Learn and grow

Invest like the best. Grow with every lesson.

Five trends that support Infrastructure and Real Estate investment

Private Equity Real Assets Funds: What They Are and What They Invest In

Secondary funds: what they invest in.

Invest like the best: finally, Private Equity for you

What's a home run and a zombie in the realm of Private Equity?

Crescenta PE Buyouts Top Performers: the plain vanilla fund with which to start building your portfolio

Differences between Private Equity Growth and Venture Capital funds

ETILFS: The next great revolution for investors

Demystifying the cascade of fees: what would your net return be with Crescenta?