Relevant factors and conditions

Before investing in private capital, it is important that you are aware of the risks associated with this type of financial asset.

Below we will explain the main aspects you should be aware of as an investor with Crescenta.

Why do we refer to them as exclusive funds?

At Crescenta both retail and professional investors can invest starting at a long-term commitment of €10,000, which will be gradually disbursed throughout the life cycle of the fund by means of regular capital calls.

In the case of retail investors, the law establishes that only those who subscribe an investment commitment of at least €100,000 and state in writing that they are aware of the risks of this commitment can invest.

If they make a lower commitment than €100,000, the law establishes that they must be advised and that the investment must be of at least €10,000, this amount not representing more than 10% of their assets and provided that these do not exceed the value of €500,000. At Crescenta we provide this service through our digital advisory tool, which is mandatory for retail investors who invest less than €100,000 and is made available to any investor that requests it when not mandatory.

In addition, at Crescenta we recommend you visit our academy, Learn and Grow, to expand your knowledge about the financial markets and be able to make an informed investment decision, while assessing the risks and main characteristics of this asset.

Who is investing in private capital funds for?

Historically, access to private capital funds of top-tier management companies has been limited to large fortunes or institutional investors. Due to the complexity and high cost of the operations, these management companies set very high minimum amounts, reaching the millions.

At Crescenta thanks to our team's broad experience, we work on establishing relationships with these top-tier funds to gain access and offer them to our investor base from €10,000 upwards.

For example, Cinven, one of the underlying funds of the Crescenta Private Equity Buyouts Top Performers fund, has established a minimum entry amount of €20 million for its funds. At Crescenta we provide you access to the Cinven fund through the portfolio with a €10,000 commitment.

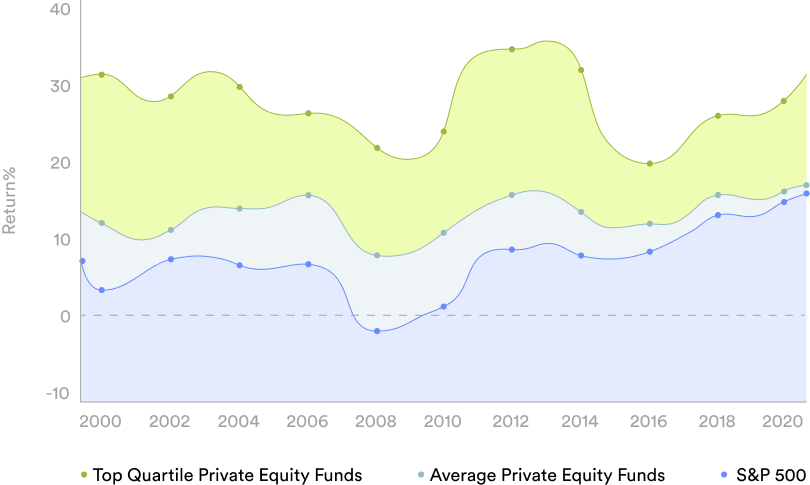

They are top-tier funds because the dispersion between the returns of private capital and top-quartile funds is very high, as can be seen in this chart. For this reason and because we seek the most attractive returns for our investors, we only provide access to top-tier or top-quartile funds.

Note: data for the USA calculated in US dollars; Cambridge Associates Modified Public Market Equivalent (mPME) seeks to replicate private investment performance under public market conditions

Past performance is not indicative of future returns. Private capital is not an index that can be invested in; therefore, it is purely an indicative comparison.

It makes reference to the top quartile of PE funds. The average of alternative funds is the average of all US PE Buyout funds. The chart shows the net IRR grouped in US Private Equity Buyout funds since 2000.Your investment in private capital could result in the total or partial loss of your capital.

What return do we expect from our fund portfolios?

Historically, investment in private markets has performed better than investment in the stock market, as we can see in the chart above. By analysing the past returns of our portfolio's underlying funds, we calculate an annualised net return (after fees) of 15%.

This target return is based on the historical net return obtained by the selected underlying funds under a conservative scenario and considering the consistency of the expected future results.

You must bear in mind that past performance is not indicative of future returns, that the value of investments and income arising therefrom can rise or drop and that there is the possibility of you not recovering the invested amount.

Why do we have the lowest market costs?

As we are a digital management company and have digitalised the entire investment process, we have been able to optime the costs and offer very competitive fees.

If we compare the funds of funds offered by the main private capital firms in Spain, Crescenta's fees are up to 50% lower in comparable classes.

In class F (the investor class with a commitment between €10,000 and €100,000) we have no competitors offering such low entry limits.

What are the risks of investing in private capital?

Like any investment, investing in private capital involves a series of risks that investors must consider before making their investment. Below, are the risks you can encounter:

- Liquidity: you must be aware that they are illiquid products, so you must have the financial standing required to undertake them. These are long-term investments, which can exceed 10 years and during which you will have to maintain your investment commitment. In addition, in the first few years you will usually obtain negative returns, since you will only make contributions to the fund and will not receive distributions usually until the end of the fifth year. This is known as the “J Curve”.

- Investment volatility: investments can experience changes in their value, without a guarantee of returns or recouping that invested, especially in unlisted companies.

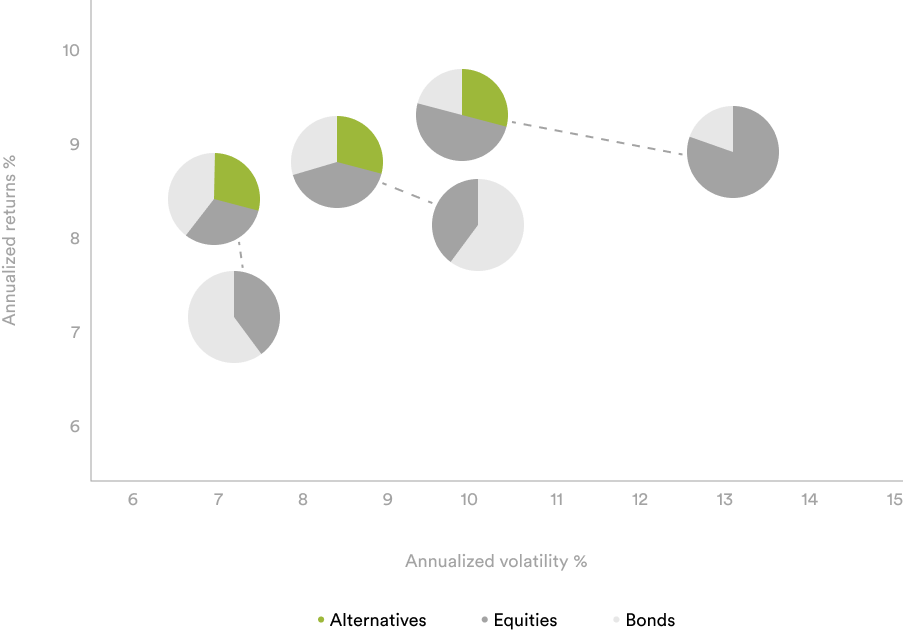

However, the inclusion of private capital funds in a traditional fixed-income and equity portfolio can also help reduce volatility, as we can see in the chart by Bain&Company. As we increase the exposure to alternatives assets, profitability increases and volatility decreases:

Source: Bloomberg, Burgiss, FactSet, NCREIF, PivotalPath, Standard & Poor’s, J.P. Morgan Asset Management. The alternatives allocation includes hedge funds, real estate, and private equity, with each receiving an equal weight. Portfolios are rebalanced at the start of the year. Equities are represented by the S&P 500 Total Return Index. Bonds are represented by the Bloomberg U.S. Aggregate Total Return Index. Volatility is calculated as the annualized standard deviation of quarterly returns. Data are based on availability as of May 31, 2025..

- Leverage: the use of debt by underlying investments can increase the risk, especially in negative return scenarios.

- Currency: investments made in currencies other than the euro are subject to changes in exchange rates, which can have an effect on the portfolio's value.

- Challenges in the acquisition of investments: the competition for investment opportunities can limit the number of opportunities available and affect the terms and conditions of investments.

- Regulatory and legal changes: changes in tax or legal regulations could have an impact on the return on investments.

- Risk of non-compliance: as an investor, you must fulfil the obligations established in the fund's documentation, otherwise you could face consequences.

- Sensitivity to the environment: environmental, social or political factors can negatively influence the value of investments.

- Fund valuation: the fund's valuation depends on the valuations provided by the management companies of underlying funds, which may differ in time and method from those reported to investors. In addition, the expenses and fees must be deducted from the total value of the investments, which can significantly affect the final value of the fund.

- Conflicts of interest: although they are managed in accordance with current regulations, there is a risk that the interests of the management company, fund and investors come into conflict.

- Limitations on information: we may not have full access to detailed information about the portfolio of underlying funds and their circumstances, which could affect investment decisions.