Crescenta opens the doors to private markets through the investment in funds. This means that you will have the opportunity to invest in non-traditional assets, making the most of the advantages of diversification, profitability and lower volatility they have to offer.

In this post we explain what private capital funds are, their advantages and the key roles involved.

Nothing like working as a team. A fund is a collective investment vehicle that is set up by gathering the money of several investors or participants. One management company will be responsible for administering and make the investment decisions. We can compare an investment fund with a pizza: when you order a pizza to share with your friends, each one contributes with an amount of money and, in exchange, receives a proportional part of the pizza.

A private investment fund is also a collective investment vehicle in which investors invest money for the management companies to administer, but it is different to a traditional fund in terms of the type of assets it invests in (unlisted companies), the time horizon (long term) and the fund's life cycle.

Unlike traditional investment funds, this life cycle is finite; it usually lasts 10 years and is divided into three stages: setting the fund and fundraising, investing and divesting, during which the participant contributes capital (through capital calls) and receives gains (distributions). These stages are not strict in order, but there may be investments and divestments at the same time, depending on the fund's needs and the opportunities found by the management companies.

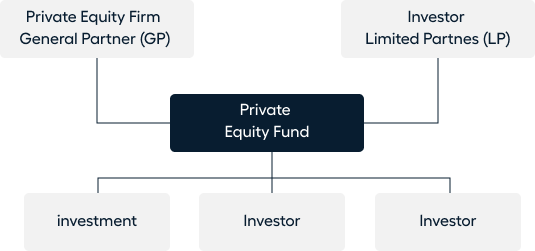

There are two key roles in private capital investment funds:

There are different types of private capital funds. At Crescenta you can invest in RCF (Risk Capital Funds) or HF (Hedge Funds), which are investment vehicles aimed at professional investors with lower diversification needs.

HF are open-ended vehicles, but with the possibility of investing in closed-ended funds. Unlike the RCF, HF can invest up to 100% of the investment in a single underlying fund, that is, they are more concentrated funds. This provides management companies greater flexibility when building the investment portfolio.

In the RCF the minimum investment for a retailer is €10,000, provided that this investment does not represent more than 10% of their assets and they have received advisory services (if their assets do not exceed the value of €500,000).

Investors (LP) will receive professional management, where a management team (GP) will make the investment decisions. The GPs have tools, information and contacts to make the best decisions, that is, resources that can hardly be matched by an individual investor.

Through these vehicles, investors can access opportunities that they would not be able to when investing as an individual. This is achieved because the funds have a greater negotiating power and a much higher volume of assets, enabling them to access a wide variety of markets and projects.

As a result, a private capital fund is able to invest in different companies, which helps build a diversified portfolio.

The characteristics of private capital funds make them an excellent regular savings instrument. Unlike traditional funds, private equity funds do not have a daily net asset value. In addition, investors do not have to disburse the amount they want to invest at the beginning, but do so as the manager (GP) requests it through capital calls. Thus, due to the gradual disbursement of capital, investing in private equity becomes an attractive way of saving.

In addition, its illiquid nature can also be an ally for savers. Investors cannot divest when they want, which is why they are said to be illiquid investments. This limited liquidity can become an advantage due to helping investors control their emotions and invest regularly, thus meeting their financial planning. However, if investors need liquidity, there is the option of selling in the secondary market.

Yet, as with all investments, it entails risks, so investors must invest considering their assets, financial knowledge, investment horizon and risk tolerance.

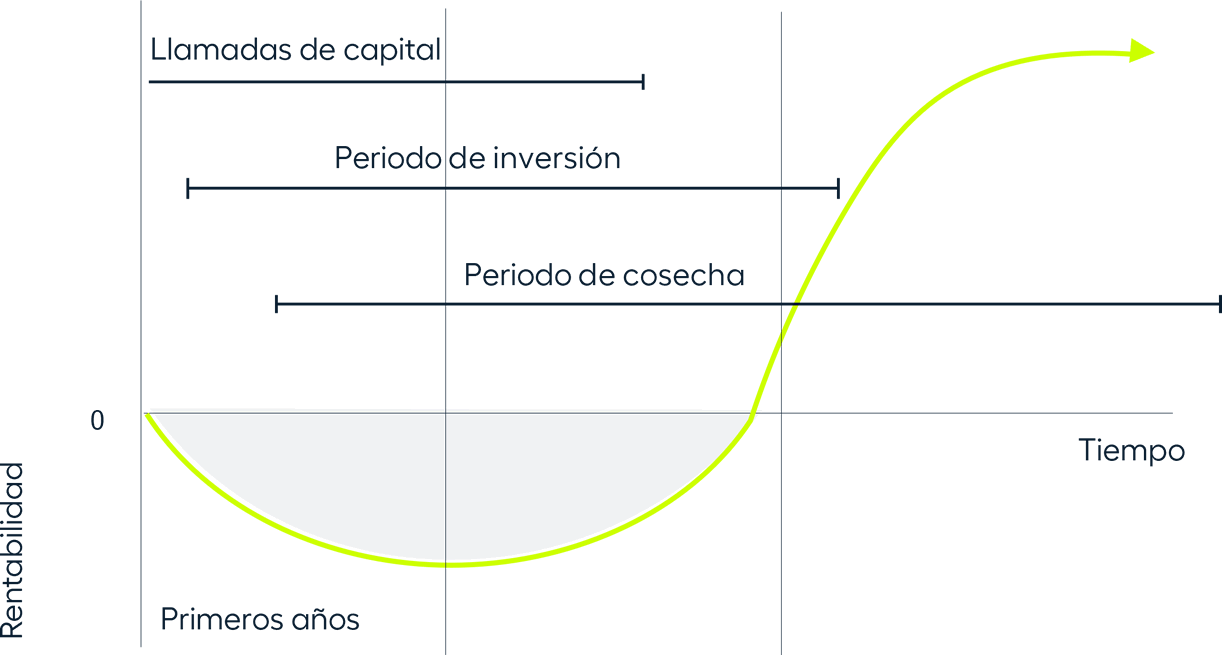

Una de las principales características de la inversión en capital privado es su orientación al largo plazo. Por el tipo de empresas y proyectos en los que invierten los fondos de capital privado, habrá que esperar más tiempo que en las inversiones tradicionales para que se materialicen las ganancias (la duración suele ser de 5 a 10 años). A cambio, el potencial de obtener rentabilidad es mucho mayor, asumiendo, por supuesto, el riesgo inherente a cualquier tipo de inversión.

En este punto, es importante estar familiarizado con la curva J, que describe la forma que suele adoptar el valor liquidativo de un fondo de inversión de capital alternativo y refleja la tendencia de estos fondos a dar resultados negativos en los primeros años. Esto ocurre por dos razones, en primer lugar, hay que tener en cuenta que la creación de valor en un negocio no es inmediata, además, hay que sumar los costes iniciales de las inversiones y las comisiones de gestión.

Conforme pase el tiempo, el fondo mejorará la eficiencia y creará valor en las empresas en las que ha invertido. En la mayoría de las ocasiones, a medida que el fondo obtenga beneficios por la venta de las empresas, el retorno de la inversión superará con creces las pérdidas iniciales.

Fuente: JP Morgan, Informe "Know your Alternatives"

Fuente: JP Morgan, Informe "Know your Alternatives"

Si quieres aprender más sobre las particularidades de los fondos de capital privado descarga nuestra guía "Particularidades de la inversión en Capital Privado: compromiso, llamadas de capital y distribuciones".

European Long-Term Investment Funds (ELTIF) are a type of fund that was created to facilitate long-term investment in the real economy. It is the only type of fund for long-term investments that can be distributed across borders between both professional and retail investors. However, only a few funds have been launched due to limitations in the distribution process and rules on the composition of portfolios.

With the aim of resolving this issue, work is being carried out at the European level on the so-called ELTIF 2.0, which will eliminate the minimum investment restrictions, among other aspects. This is great news for retail investors, as they will be the main beneficiaries thereof, but it is also great news for Crescenta, which is very well positioned to be an early adopter and thus strengthen its mission to democratise investment.

The more active retail investors will be able to invest in more concentrated funds to build a tailored portfolio that completely meets its risk profile and interests.

Author

Sofía Cisneros

Comunicación y contenidos - Crescenta

A GP raises capital and searches, executes and manages the fund's investments.

Investing in private capital funds is a liquid investment

Private capital investment is short-term oriented

When you click on any underlined term, you can see a definition and example of each concept

When you click on any underlined term, you can see a definition and example of each concept

When you click on any underlined term, you can see a definition and example of each concept