Boost your portfolio by investing with and like the best

Unique returns

Unique returns

Curated selection of funds, incorporating only those with returns well above average

Our target is to provide you net annual returns above 15%*, regardless of the investment ticket size

*Target based on the historical net returns obtained by the selected underlying funds under a conservative scenario and considering the consistency of the expected future results

Unprecedented access

Unprecedented access

Invest from €10,000 upwards in funds with a minimum entry ticket of millions of euros

Thanks to the design of our proprietary software, we have digitalised the entire investment process, which enables us to offer lower entry limits and fees

Competitive conditions

Competitive conditions

We only choose top tier funds. We will inform you at all times of your investment, treating the collection of commissions with total transparency

* Target based on the historical net performance obtained by the selected underlying funds, under a conservative scenario and considering the consistency of the expected future results.

** You may invest a minimum of 10,000 euros if this amount does not represent more than 10% of your assets, and provided you do so under our financial advisory service.

First steps

as an investor

During the first 5 years you disburse your investment commitment, gradually, and in the following 5 years you will receive distributions

All projections or other estimates included, including estimates of profitability, are predictions based on factors beyond Crescenta's control and are not contractually binding. Past performance is no guarantee of future performance.

More information on risks and conditions here

How do I start?

Create your free

account

Register and complete your investor profile in less than 10 minutes and 100% online. The process has no cost and requires no investment commitment

Recieve digital

financial* advice

We will generate a personalized investment proposal tailored to your preferences and investor profile through an intuitive process

Accesses Private Equity

funds

Consult the funds in which you can invest according to your profile and build your portfolio. View your investments and upcoming opportunities in your private area

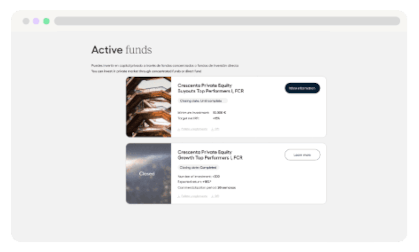

Active Funds

You will be able to invest in private capital through a concentrated fund portfolio or by investing directly in a fund

It invests primarily in infrastructure, real estate and energy, with a focus on the US market. Its objective is to generate returns through asset appreciation and the income streams they produce, offering diversification and inflation protection.

Top Performers II, FCR

It is a portfolio of funds that invests in the main international funds of the Private Equity Buyouts strategy. This strategy is dedicated to taking majority positions in mature companies and applies strategies focused on business growth through operational and financial improvements over an average period of 3 to 5 years.

Funds portfolio (fund of funds) with a main focus on Large Buyout top quartile-Flagship strategy funds: Cinven, EQT, Alpinvest, New Mountain... The fund consists of funds that mainly take majority positions (control position) in mature enterprises…

This fund portfolio (fund of funds) invests in Private Equity Growth Global Top Tier funds: Insight and G Squared. The strategy is based on acquiring mainly European technology companies in their growth phase. It consists of funds...

*Target based on the historical net performance of the selected underlying funds, under a conservative scenario and considering the consistency of expected future results. More information about risks and conditions here

We recommend that you use the financial advisory tool and consult upcoming fund launches for optimal planning and to build a diversified private equity portfolio